Find depreciation rate calculator

Ad Get A Free No Obligation Cost Segregation Analysis Today. Car Age 1 year 2 years.

Depreciation Rate Formula Examples How To Calculate

The following formula determines the rate of depreciation under this method.

. Depreciation Amount Asset Value x Annual Percentage. The most widely used method of depreciation is the straight-line method. Ad Need an Easy Accurate Way to Comply with State Depreciation Across Multiple States.

Depreciation Rate per year. After a year your cars value decreases to 81 of the initial value. Where Di is the depreciation in year i.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. The depreciation rate is the annual depreciation amount total depreciable cost. The calculator should be used as a general guide only.

This unique AssetAccountant search tool allows you to search fixed assets to determine the appropriate fixed asset depreciation. This depreciation rate schedule is used to recalculate depreciation balances and to update the service life of the fixed asset. There are many variables which can affect an items life expectancy that should be taken into consideration.

First year depreciation 12-M05 12. In this case the machine has a straight-line depreciation rate of 16000 80000 20. Enter your starting quote exchange rate 1.

Select your Quote Currency. Depreciation in Any Full year Cost Life Partial year depreciation when the property was put into service in the M-th month is taken as. You can import a Microsoft Excel file that contains.

Ad Get A Free No Obligation Cost Segregation Analysis Today. Adjusted cost basis Purchase price Improvements Accumulated depreciation or depreciation deductions 7000 0 4200. The MACRS Depreciation Calculator uses the following basic formula.

Reduce Your Income Taxes - Request Your Free Quote - Call Today. Depreciation rate finder and calculator You can use this tool to. Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence.

Depreciation Rate 2 x Straight-Line Depreciation Percent Depreciation for a Period Depreciation Rate x Book Value at Beginning of the Period If the first year is not a full 12. D i C R i. 1useful life of the asset.

Car Age 3 years 4 years. Build Your Future With a Firm that has 85 Years of Investment Experience. Find the depreciation rate for a business asset calculate depreciation for a business asset using either the diminishing value.

Car Age 2 years 3 years. After two years your cars value. Reduce Your Income Taxes - Request Your Free Quote - Call Today.

C is the original purchase price or basis of an asset. Calculator Use Select your Base Currency that you want to quote against. Calculate adjusted cost basis.

This rate is calculated as per the following formula. The calculator also estimates the first year and the total vehicle depreciation. These are set at 1 base currency unit.

Calculate your fixed asset depreciation rateeffective life. Car Age 4 years 5 years. Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae.

1 nth root of Residual ValueCost of the asset 100 where n useful life Related Topics Depreciation. We will even custom tailor the results based upon just a few of. First year depreciation M 12 Cost - Salvage Life Last year depreciation 12 - M 12 Cost - Salvage Life And a life for example of 7 years will be depreciated across 8.

This Car Depreciation Calculator allows you to estimate how much your car will be worth after a number of years. Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade. Our car depreciation calculator uses the following values source.

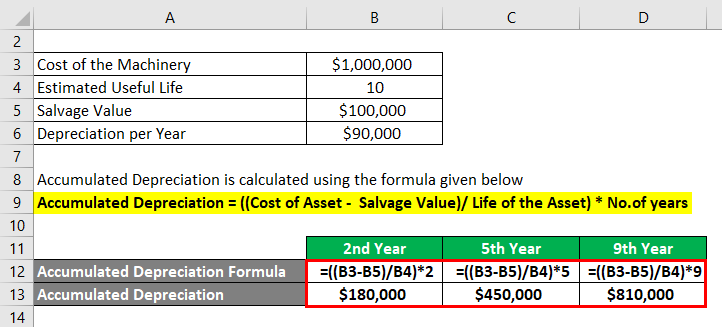

Accumulated Depreciation Formula Calculator With Excel Template

Depreciation Rate Formula Examples How To Calculate

Depreciation Calculator

Straight Line Depreciation Formula And Calculator

Depreciation Formula Calculate Depreciation Expense

Annual Depreciation Of A New Car Find The Future Value Youtube

Depreciation Formula Calculate Depreciation Expense

Accumulated Depreciation Formula Calculator With Excel Template

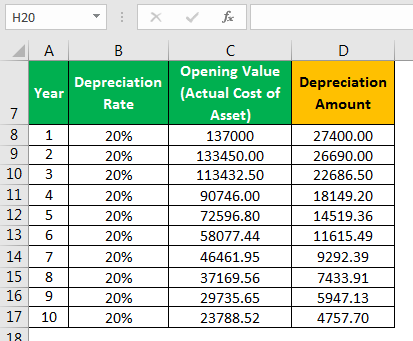

Depreciation Formula Examples With Excel Template

Depreciation Calculation

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Double Declining Balance Depreciation Calculator

Free Macrs Depreciation Calculator For Excel

Depreciation Formula Calculate Depreciation Expense

Depreciation Calculator

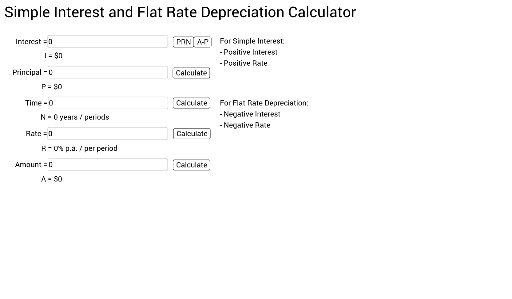

Simple Interest And Flat Rate Depreciation Calculator Geogebra

Depreciation Rate Formula Examples How To Calculate